Without congressional action on the Build Back Better Act in 2022 the Child Tax Credit would revert back to 2000 per qualifying child subject to. IRS practice units on the base.

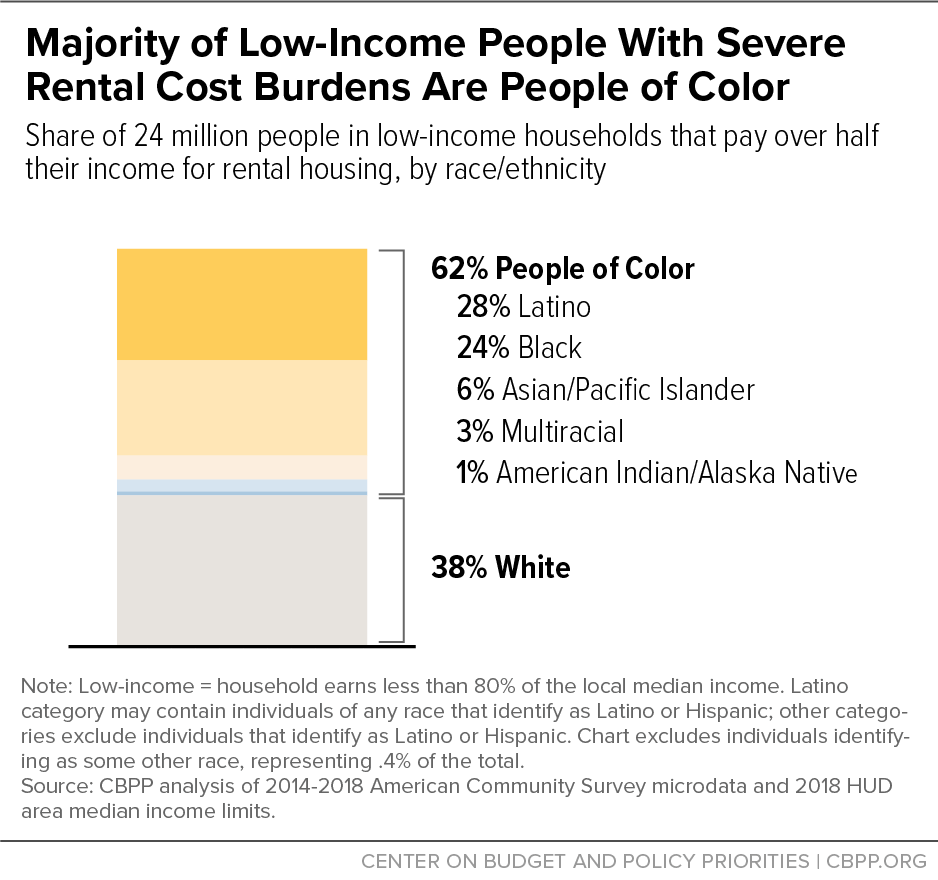

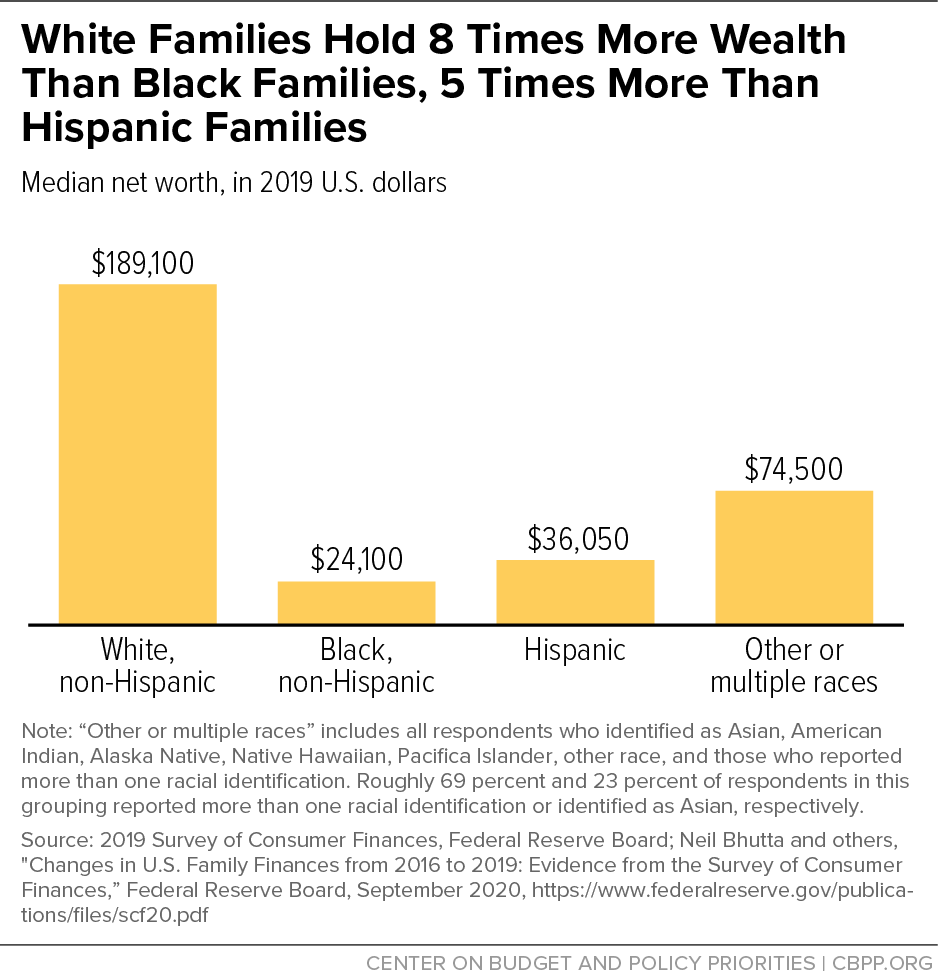

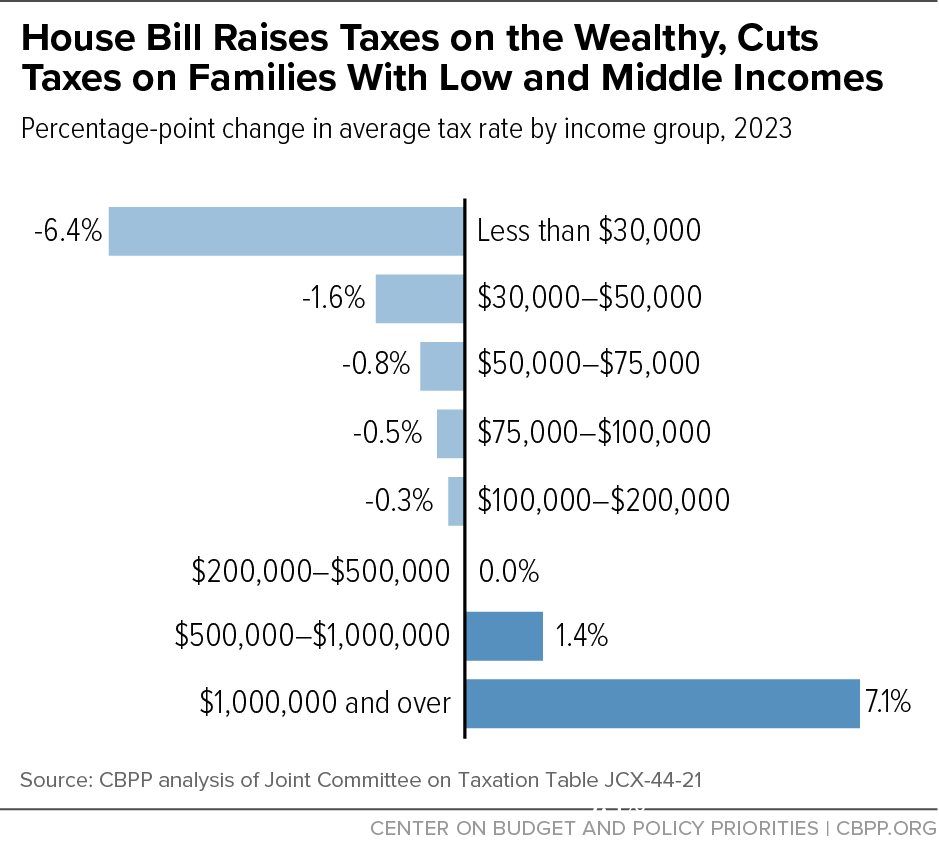

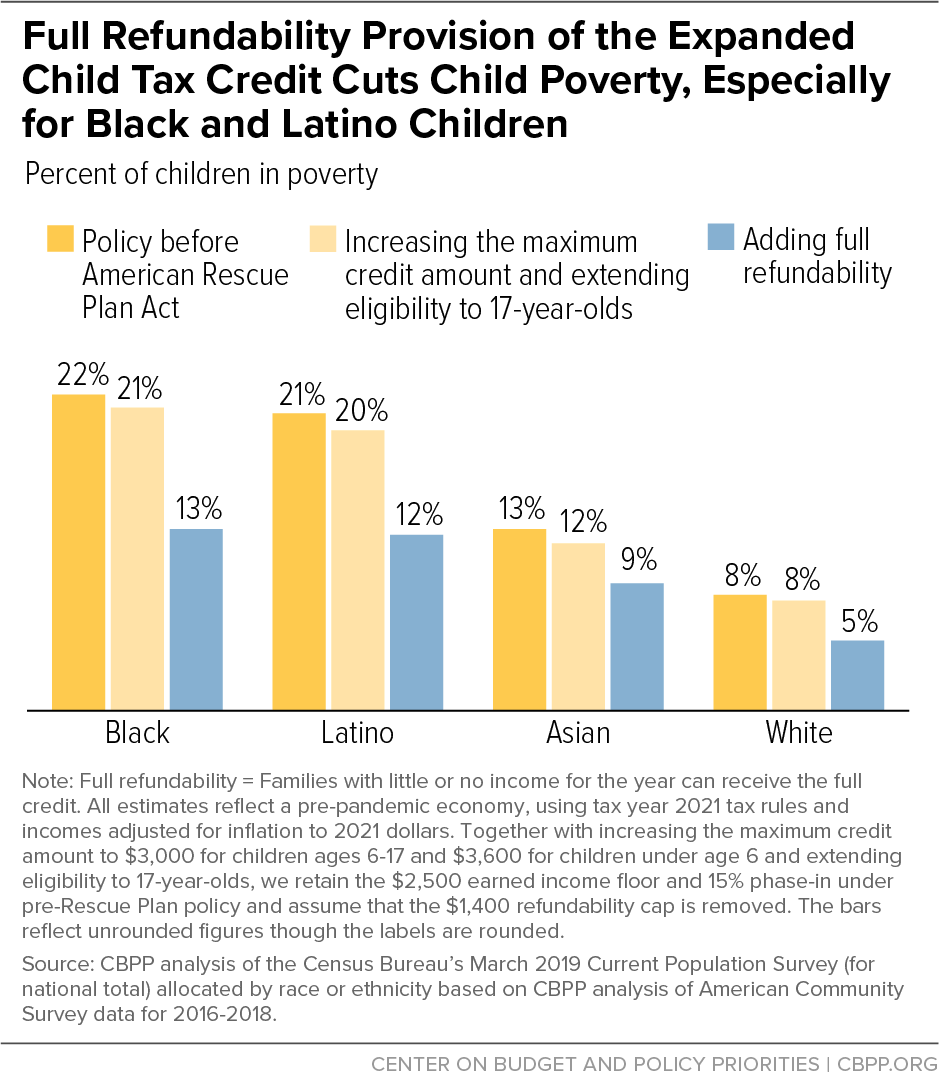

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

When you own an asset for more than a year and sell it for a profit the IRS classifies that income as a long-term capital gain.

. Comments on the corporate and international tax provisions of the stalled Build Back Better Act. Being a property owner you at least have a place to live if nothing else. Previously this reduction was not scheduled to take place until.

Here are the long-term capital gains tax brackets for 2020 and 2021. In their latest installment of US. The new exemption amount would be 5 million indexed for inflation dating back to 2010.

Instead of taxing it at your regular income tax rate they tax it at the lower long-term capital gains tax rate 15 for most Americans. Tax Review co-authors James Fuller Larissa Neuman and Julia Ushakova-Stein examine recent OECD developments including the updated transfer pricing guidelines and the pillar 2 model rules. You can collect rent to generate a flow of cash on a regular basis or sell property to get a large sum when needed.

Giftestate and GST lifetime exemptions The proposal would roll back the giftestate and GST lifetime exemptions to one-half the current levels set in 2017 effective January 1 2022. The Tax Cuts and Jobs Act which was enacted in December 2017 provided that the current 10000000 base exemption amount for the estate gift and Generation-Skipping Transfer taxes is effective through 2025 and reverts on January 1 2026 to the 5000000 base exemption amount established by the American Taxpayer Relief Act of 2012. A real estate investment was usually held up as the best option if one had the money to back it up.

The traditional view was that investing in real estate gave you a tangible asset like no other.

Proposed Federal Tax Law Changes Affecting Estate Planning Davis Wright Tremaine

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Estate Tax Exemption 2021 Amount Goes Up Union Bank

/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 Definition

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More