For the Towns of Hempstead North Hempstead and Oyster Bay this includes both the full General Taxes and School Taxes. 179 of home value Yearly median tax in Nassau County The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900.

Long Island Property Tax Reduction Savings Suffolk Nassau Counties Tax Reduction Services

Welcome to the Nassau County Property Appraisers website.

. Walter Junior Boatright Building. The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data district information tax maps property photographs past taxes tax rates exemptions with amounts and comparable sales. Assessment Challenge Forms Instructions.

The median property tax also known as real estate tax in Nassau County is 157200 per year based on a median home value of 21360000 and a median effective property tax rate of 074 of property value. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year. The Nassau County sales tax rate is 425.

The City of Glen cove handles their own School. The County Executive has proposed taking 100 million from Nassau Countys allocation of funds from the American Rescue Plan and distributing this money directly to residents. While the 2 percent figure is well above the 156 percent increase provided for in 2021 its good news for Nassau County homeowners already struggling with some of the highest property tax rates in the US.

The Nassau County sales tax rate is 425. Tax Rate Per 1000 of Full Value City of Glen Cove. Nassau County Florida Property Tax Go To Different County 157200 Avg.

2021 Nassau County Municipal Tax Rates. Posted on August 24 2021 August 23 2021 by Suanne Thamm. Complete guide covering the Nassau County property tax rate county town village school taxes due dates Nassau County property search payments more.

Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. How much are taxes in Nassau County. 074 of home value Yearly median tax in Nassau County The median property tax in Nassau County Florida is 1572 per year for a home worth the median value of 213600.

One-time payments to. Michael Hickox CFA 96135 Nassau Place Suite 4 Yulee FL 32097 Phone. Rules of Procedure PDF Information for Property Owners.

Processing applications for property tax exemption and the Basic and Enhanced STAR programs for qualifying Nassau County homeowners. Walter Junior Boatright Building. Nassau County New York Property Tax Go To Different County 871100 Avg.

NASSAU COUNTY PROPERTY APPRAISER A. Pay Delinquent Property Taxes. Calculate the Estimated Ad Valorem Taxes for your Property.

45401 Mickler Street Callahan FL 32011. 2022 Final Assessment Roll for City of Glen Cove. Ad Enter Any Address Receive a Comprehensive Property Report.

It is also linked to the Countys Geographic Information System GIS to provide. Nassau County collects on average 179 of a propertys assessed fair market value as property tax. Notice of Proposed Property Taxes for Nassau County property owners.

From The County Insider Office of the Nassau County Manager August 24 2021 82321 400 pm. 20222023 Tentative Assessment Rolls. County Nassau County Department of Assessment 516 571-1500 General Information Provides information from the Department of Assessment on rules procedures exemptions and general information.

I would like to take this opportunity to thank you for the trust you have placed in me by electing me to be your Property Appraiser. The New York state sales tax rate is currently 4. City of Long Beach.

This is the total of state and county sales tax rates. The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes. Calculate the Estimated Ad Valorem Taxes for your Property.

How To Get To Comfort Suites. The Tax Records department of the Treasurers Office maintains all records of and collects payments on delinquent Nassau County Property Taxes. 45401 Mickler Street Callahan.

20212022 Final Assessment Rolls. This is the total of state and county sales tax rates. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863.

If you have any questions please contact us. You might be interested. The Nassau County Property Appraisers Office makes no warranties expressed or implied concerning.

This tax cap applies to the Nassau County general tax levy which is a portion of all homeowners tax bills. - Nassau County Property Appraiser A. The plan which will result in payments of up to 375 for qualifying residents has been approved by the Nassau County Legislature.

Exemptions and proposed taxes are for 2021. Florida is ranked number twenty three out of the fifty states in order of the average amount of property taxes collected. Nassau County Tax Lien Sale.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. How to Challenge Your Assessment. See Results in Minutes.

3 discount if paid in the month of December 2 discount if paid in the month of January 1 discount if paid in the month of February Full amount if paid in the month of March no discount applied The full amount is due by March 31st and if not paid becomes delinquent on April 1st Payment Options Pay Online Pay in person Pay by mail Escrow. Discover the Registered Owner Estimated Land Value Mortgage Information. Nassau County collects on average 074 of a propertys assessed fair market value as property tax.

Wont my property taxes go down if my assessment goes down. The New York state sales tax rate is currently 4.

Property Taxes In Nassau County Suffolk County

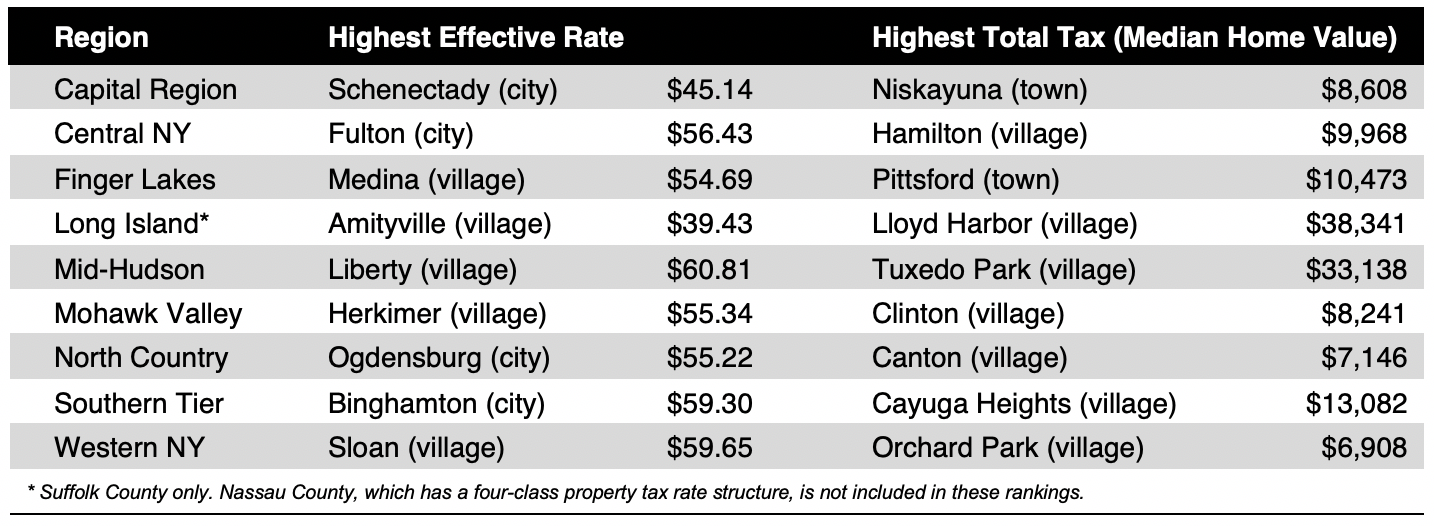

Compare Your Property Taxes Empire Center For Public Policy

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

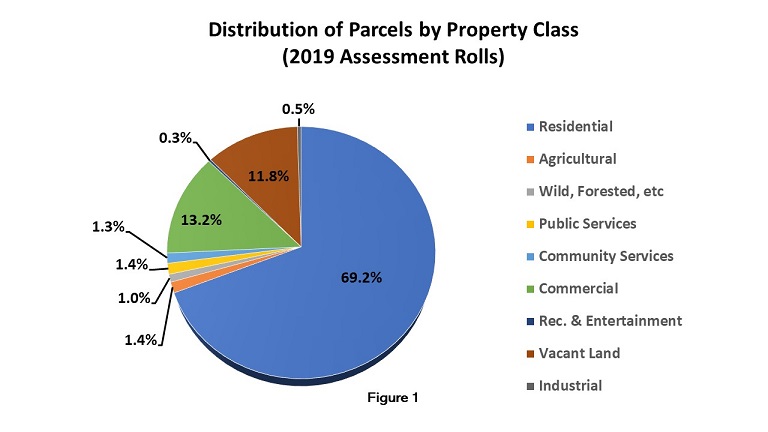

Distribution Of Parcels By Property Class Code 2019 Assessment Rolls

New York Property Tax Calculator 2020 Empire Center For Public Policy

Nassau County Ny Property Tax Search And Records Propertyshark

Property Taxes In Nassau County Suffolk County

Nassau County Ny Property Tax Search And Records Propertyshark

How Parasites Poison Nyc Suburbs Property Tax System

Property Tax By County Property Tax Calculator Rethority

Nassau County Property Tax Reduction Tax Grievance Long Island

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Property Taxes In Nassau County Suffolk County

Definitive Guide To Property Taxes In 2021 Suffolk Nassau Ny

Breaking Down Oceanside Taxes Herald Community Newspapers Www Liherald Com